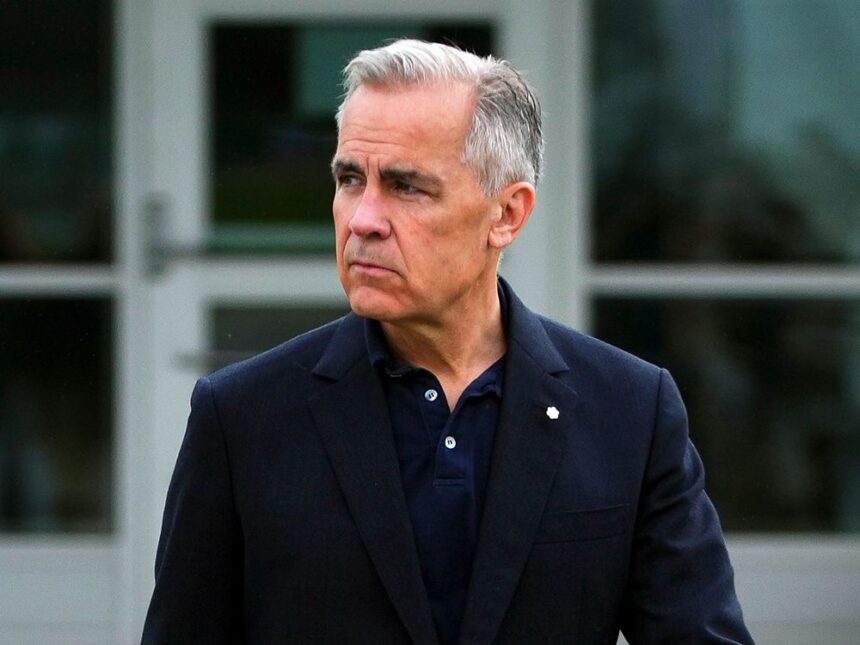

In a striking development that has sent ripples through Canada’s political and financial circles, Mark Carney, the former Bank of Canada and Bank of England governor, has been compelled to recuse himself from discussions involving more than 100 companies due to potential conflicts of interest. This extensive recusal comes as Carney serves as an informal economic advisor to Prime Minister Justin Trudeau while maintaining his position at Brookfield Asset Management, raising serious questions about the intersection of public service and private interests.

Carney, who joined Brookfield in 2020 as Vice Chairman and Head of Impact Investing, has found himself navigating an increasingly complex ethical landscape. Documents obtained through access to information requests reveal that his advisory role to the government necessitated stepping back from conversations involving dozens of major corporations where his Brookfield connections could present conflicts.

“The sheer scale of these recusals highlights a fundamental challenge in government advisory roles,” explains Dr. Melissa Thompson, professor of political ethics at the University of Toronto. “When someone with Carney’s extensive private sector ties takes on public responsibilities, the potential for overlapping interests becomes almost unavoidable.”

According to CO24 Politics analysis, the conflict management strategy was established through consultations with the Privy Council Office and the Ethics Commissioner. The arrangement allows Carney to continue advising on broad economic policy while being excluded from specific discussions that could benefit Brookfield or its numerous investments.

The revelation comes at a particularly sensitive time as speculation continues to swirl about Carney’s potential political ambitions. Many Canada News observers have long considered him a possible Liberal Party leadership candidate, with his economic credentials potentially positioning him as Trudeau’s successor.

“This situation creates an unusual predicament,” notes political strategist James Richardson. “Carney’s economic expertise is precisely what makes him valuable to government, yet his corporate connections—which stem from that same expertise—now limit his ability to provide comprehensive advice.”

Brookfield’s vast portfolio spans infrastructure, renewable energy, real estate, and private equity across multiple continents. With assets under management exceeding $700 billion, the firm’s interests touch virtually every sector of the CO24 Business landscape, making Carney’s recusal list necessarily extensive.

The Prime Minister’s Office has defended the arrangement, stating that appropriate safeguards are in place to ensure ethical standards are maintained. However, opposition parties have seized on the issue, questioning whether such widespread conflicts render Carney’s advisory role effectively compromised.

Conservative finance critic Pierre Poilievre remarked, “When your conflicts list is longer than a phone book, perhaps that’s a sign you shouldn’t be advising government at all.”

The situation underscores a broader challenge facing governments worldwide—how to attract top talent from the private sector without inviting conflicts that undermine public trust. As the lines between business and government advisory roles continue to blur, Carney’s case may serve as a cautionary example of the difficulties in balancing private sector expertise with public service integrity.

As Canada navigates complex economic challenges post-pandemic, the question remains: can we develop more effective models for incorporating private sector expertise into government without compromising ethical standards, or does Carney’s extensive recusal list suggest we’ve reached the practical limits of such arrangements?