The thunder of rapid-fire questions fills the conference room as JPMorgan’s veteran analyst Mike Mayo grills banking executives about their quarterly performance. Except it isn’t Mayo asking the questions—it’s an AI replica, indistinguishable in tone and analytical approach from the real financial expert. This scenario, once confined to science fiction, now stands at Wall Street’s doorstep as deepfake technology infiltrates the financial sector’s analytical landscape.

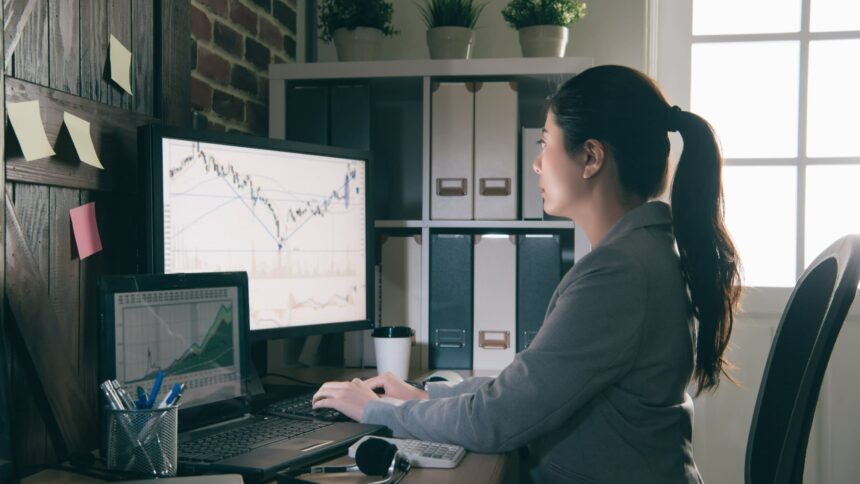

Financial institutions across North America are quietly experimenting with AI systems capable of mimicking star analysts, creating what insiders call “synthetic analysts” that could revolutionize investment research. These systems, trained on thousands of earnings calls and analyst reports, can generate comprehensive financial assessments that capture the nuanced expertise and even the personality traits of top performers.

“What we’re witnessing isn’t just automation—it’s the replication of specialized financial intelligence,” says Dr. Elena Ramirez, fintech innovation researcher at the Vancouver Financial Technology Institute. “These systems don’t just process data; they apply judgment and perspective modeled after human experts.”

At Goldman Sachs and Morgan Stanley, pilot programs allow institutional clients to interact with AI models that simulate conversations with specific analysts, providing tailored market insights without human intervention. The implications are profound—a single top-tier analyst could effectively be “present” at hundreds of earnings calls simultaneously, asking pointed questions informed by historical data patterns invisible to human observation.

The technology isn’t without precedent. Synthetic media has already transformed other industries, with AI voice replicas reading audiobooks and digital avatars delivering news broadcasts. Financial analysis represents a natural evolution, particularly as institutions seek to maximize their most valuable human resources.

Regulatory concerns loom large, however. The SEC has signaled heightened scrutiny of AI-generated financial content, particularly regarding disclosure requirements. “When investors engage with what they believe is human analysis, but is actually machine-generated content modeled after a human analyst, we enter uncertain ethical territory,” notes SEC Commissioner Hester Peirce in a recent policy statement.

Leading financial institutions are navigating these waters cautiously. TD Bank’s recent implementation requires all AI-generated analysis to carry clear disclaimers, while Scotiabank is developing a blockchain verification system to authenticate human versus synthetic financial guidance.

For the financial media, the implications are equally significant. Traditional analysis dissemination channels could find themselves competing with direct-to-investor AI systems that deliver personalized insights at scale. CO24 Business has learned that several major financial news organizations are already investigating their own synthetic analyst platforms to maintain relevance.

The competitive advantage for institutions that successfully deploy this technology could be substantial. Early adoption by Canada’s “Big Five” banks could dramatically expand their research capabilities without proportional increases in analyst headcount, allowing them to cover previously under-analyzed market segments.

Investors may soon face a new reality where the line between human and synthetic analysis blurs beyond recognition. As these systems proliferate, the critical question becomes not whether we can distinguish human from machine analysis, but whether the distinction will ultimately matter.

Will markets eventually value the consistent, data-driven insights of AI systems above the occasionally brilliant but inherently limited analysis of human experts? The answer may reshape financial analysis as we know it.