In a decisive move that has sent ripples through North American trade relations, Ottawa unveiled a comprehensive package of counter-tariffs against the United States yesterday, marking what analysts are calling Canada’s most strategic trade response in decades. The carefully calibrated measures target $25 billion worth of American imports, specifically designed to apply maximum pressure on politically sensitive regions while minimizing disruption to Canadian supply chains.

“These counter-measures weren’t developed overnight,” explains Finance Minister Chrystia Freeland during yesterday’s announcement. “We’ve crafted a response that defends Canadian interests while sending a clear message that unilateral trade actions have consequences across borders.”

The Canadian counter-tariffs, which take effect July 1, 2025, mirror the 25% duty rate imposed by Washington last month but diverge significantly in their tactical approach. Unlike the broad-spectrum American tariffs, Canada’s response precisely targets goods from swing states critical to the upcoming U.S. election cycle – including agricultural products from Wisconsin, automotive parts from Michigan, and steel components from Pennsylvania.

Economic analysts from the Royal Bank of Canada note this approach represents a departure from Canada’s traditional trade defense strategy. “What we’re seeing is a sophisticated understanding of both economic and political leverage,” says Meredith Williams, RBC’s senior trade analyst. “The Canadian government has clearly learned from previous trade disputes that effective counter-measures must create focused pressure points rather than simply matching dollar for dollar.”

The impact on Canadian consumers appears to have been carefully considered. The tariff list notably excludes essential consumer goods and products without readily available domestic alternatives. Instead, it concentrates on intermediate industrial inputs where American suppliers compete with multiple international sources.

Industry reaction across Canada has been cautiously supportive. The Canadian Manufacturers & Exporters association released a statement acknowledging the “unfortunate necessity” of the measures while expressing appreciation for the government’s consultative approach. “Our members provided extensive input on which counter-tariffs would cause minimal disruption to Canadian manufacturing while creating legitimate incentives for the U.S. to return to the negotiating table,” the statement reads.

For Canadian businesses caught in the crossfire, the Department of Finance has established a $2.3 billion transition assistance program to help firms adjust supply chains and explore new markets. The program includes targeted support for small and medium enterprises that may lack the resources to quickly pivot from established American suppliers.

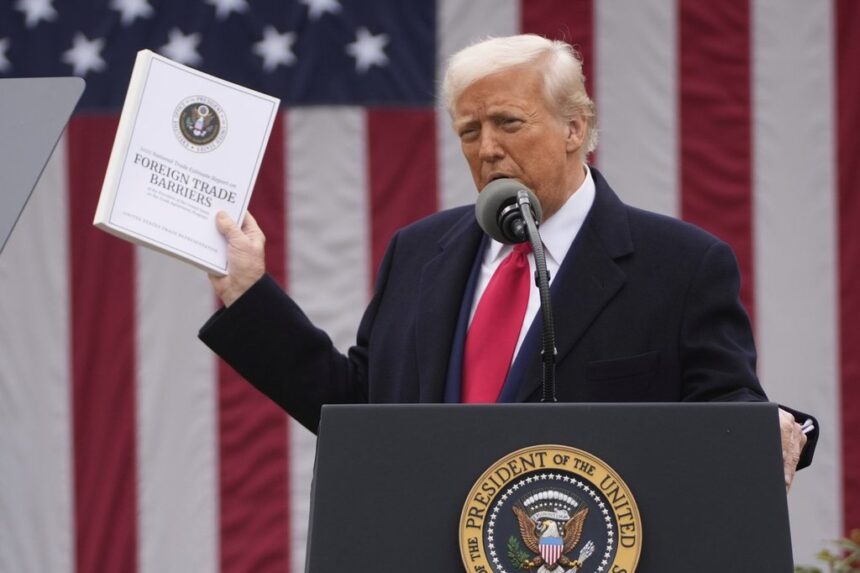

The counter-tariffs come after three months of increasingly tense negotiations failed to resolve disputes over the original U.S. measures, which Washington justified on national security grounds – a rationale Ottawa and many international trade experts have dismissed as thinly veiled protectionism.

“When you look at the global economic landscape, these tit-for-tat measures represent more than just bilateral friction,” notes Dr. Eleanor Park, international trade professor at McGill University. “They signal a troubling erosion of the rules-based trading system that middle powers like Canada have traditionally championed.”

Ottawa has emphasized that the counter-tariffs can be lifted immediately if Washington withdraws its measures, suggesting a clear path toward de-escalation. Canadian diplomats continue working through multiple channels, including the revised NAFTA dispute resolution mechanisms and broader multilateral forums.

As businesses on both sides of the border prepare for the new trade reality, the fundamental question remains: will these calculated counter-measures bring the U.S. back to meaningful negotiations, or are we witnessing the beginning of a prolonged period of economic nationalism that could fundamentally reshape North American trade patterns for years to come?