The paradox of Canada’s housing market has reached new heights as renters continue to struggle with affordability despite recent price decreases in major urban centers. A comprehensive analysis released yesterday reveals that even with modest rental price declines in cities like Toronto and Vancouver, the fundamental affordability crisis remains entrenched for millions of Canadians.

“We’re witnessing a troubling disconnect between market adjustments and actual lived experiences,” explains housing economist Dr. Amrita Singh. “While headlines trumpet minor price reductions, the reality on the ground is that average Canadians are still allocating unsustainable portions of their income toward housing.”

The report, compiled by the Canadian Housing Observatory, indicates that despite a 3.2% decrease in average rental prices across major metropolitan areas over the past quarter, the average renter is still spending approximately 42% of their income on housing—well above the 30% threshold considered financially healthy by experts.

This discrepancy is particularly pronounced in mid-sized cities like Halifax, Ottawa, and Calgary, where rental markets have traditionally been more stable. These regions are now experiencing unprecedented pressure as population shifts away from the most expensive urban centers create new demand patterns that local housing stocks cannot accommodate.

The affordability challenge extends beyond just monthly payments. According to data from Canada News, the average security deposit requirement has increased by 18% year-over-year, creating substantial upfront barriers for prospective tenants already struggling with inflation across other essential expenses.

“What we’re seeing is a perfect storm of economic factors,” notes financial analyst Morgan Zhang. “Even as headline rental prices ease slightly, the broader economic context—rising utilities, increased grocery costs, and stagnant wages—means housing affordability is actually worsening for many families.”

The federal government’s National Housing Strategy, launched in 2017 with promises to address these challenges, has come under renewed scrutiny. Recent analysis from CO24 Politics suggests that despite billions in allocated funding, new affordable housing units are being created at less than half the rate needed to meet current demand.

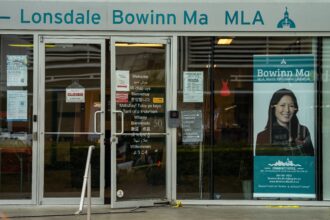

Provincial responses have varied significantly. British Columbia’s rent control measures have provided some stability for existing tenants but have simultaneously discouraged new rental development. Ontario’s removal of rent control for new buildings has increased supply but at price points inaccessible to average earners.

The rental crisis has begun impacting broader economic indicators. Research published in CO24 Business demonstrates that employers in high-cost regions are reporting increasing difficulty attracting talent, with 68% of businesses surveyed citing local housing costs as a major impediment to recruitment.

Community advocates have proposed various solutions, from inclusionary zoning requirements to tax incentives for purpose-built rental developments. “The evidence clearly shows we need multilayered approaches,” argues Sanjay Patel of the Affordable Housing Coalition. “No single policy can address the complexity of this crisis.”

Perhaps most concerning is the intergenerational impact of the rental crisis. Young Canadians are delaying major life milestones—from starting families to pursuing education—as housing consumes ever-larger portions of their income. A striking 42% of renters under 30 report having postponed or abandoned plans to start families specifically due to housing costs.

As policymakers grapple with these challenges, the fundamental question remains: in a country with abundant space and resources, why does adequate, affordable housing remain out of reach for so many? The answer likely requires rethinking our approach to housing—not merely as a market commodity but as essential infrastructure necessary for social and economic wellbeing.