In a move that has sent ripples through Canada’s energy sector, U.S. petroleum giant Sunoco’s $2.8 billion takeover bid for Calgary-based Parkland Corporation has ignited a fierce national debate about foreign ownership and energy sovereignty at a time when the global energy landscape is undergoing dramatic transformation.

The proposed friendly takeover, announced last week, would see one of Canada’s largest independent fuel retailers and convenience store operators fall under American control, raising pointed questions about the nation’s ability to maintain decision-making power over its critical energy infrastructure.

“This isn’t simply a corporate transaction—it’s about who controls the distribution networks that millions of Canadians rely on daily,” said Dr. Martha Reynolds, energy policy specialist at the University of Calgary. “When foreign entities acquire major players in our energy supply chain, Canadians lose a degree of control over pricing, service priorities, and regional investment decisions.”

Parkland currently operates over 4,000 retail locations across Canada, the United States, and Caribbean nations under various brands including Ultramar, Chevron, Pioneer, and its flagship Parkland stores. The company also manages commercial fuel delivery networks and three refineries, making it a cornerstone of Canada’s downstream energy infrastructure.

Industry analysts point to a growing trend of international consolidation in the petroleum sector as traditional fuel retailers position themselves for the coming energy transition. Richard Campos, senior analyst with Toronto-based Hammond Energy Consultants, told CO24 that the timing is particularly significant.

“We’re seeing major petroleum companies globally making strategic moves to secure market share while simultaneously preparing for decreased fossil fuel demand in coming decades,” Campos explained. “For American companies, Canadian assets are particularly attractive given regulatory similarities, geographic proximity, and the stability of the Canadian market.”

The potential sale has prompted stark divides in political responses. Conservative critics have highlighted the deal as evidence of waning investor confidence in Canada’s energy sector under current federal policies, while government supporters counter that the interest demonstrates the enduring value of Canadian energy assets.

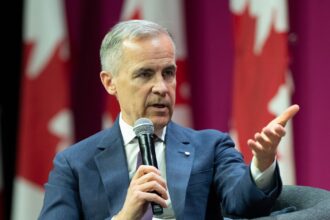

Federal Industry Minister François-Philippe Champagne confirmed the transaction will face review under the Investment Canada Act, which examines whether foreign investments provide a “net benefit” to Canada. “We always look at these transactions through the lens of what’s in Canada’s national interest,” Champagne stated at a press conference in Ottawa.

For communities where Parkland maintains significant operations, particularly in Western Canada, the stakes feel deeply personal. In Calgary, where the company employs approximately 1,200 people at its headquarters, concerns about potential job losses and diminished corporate presence have already emerged.

“These headquarters jobs are exactly the kind of high-skilled positions our province has been working to cultivate,” noted Alberta Economic Development Minister Jacob Miller. “While we welcome foreign investment, we need assurances about Sunoco’s long-term commitment to maintaining these operations.”

Energy sovereignty concerns extend beyond corporate headquarters and into questions about critical infrastructure. Parkland’s Burnaby refinery in British Columbia supplies approximately 25% of that province’s transportation fuel needs, making it a strategically significant asset for regional energy security.

Dr. Eleanor Chen, professor of international business at Queen’s University, suggests the transaction reflects broader global currents. “We’re witnessing a general trend toward economic nationalism in many countries, particularly around essential services and infrastructure,” Chen observed. “The question for Canada is where we draw the line between welcoming foreign investment and protecting strategic national interests.”

The Investment Canada review is expected to take several months, during which time both companies have pledged to engage with stakeholders and address concerns. Sunoco executives have already made preliminary commitments to maintain Canadian operations and explore expansion opportunities, though skeptics note that such promises often face revision once deals are finalized.

As this transaction advances through regulatory channels, Canadians face a fundamental question that extends far beyond corporate boardrooms: in an era of energy transition and growing geopolitical uncertainty, how much control should a nation maintain