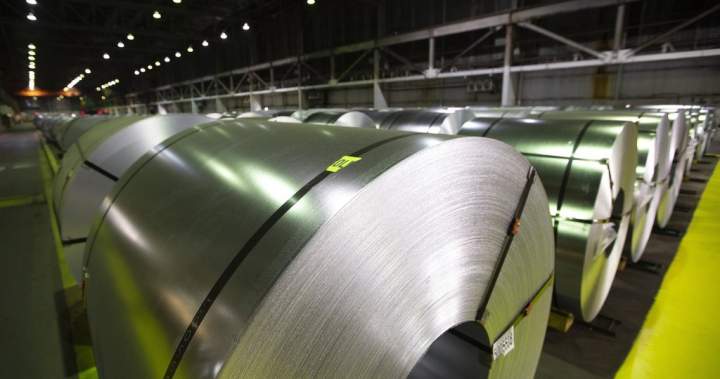

The steel mills of Hamilton, Ontario stand as silent witnesses to a deepening economic standoff. As US President Joe Biden’s administration doubles tariffs on Chinese steel to 25% while proposing a quadrupling of duties on aluminum to 20%, Canadian producers find themselves caught in the turbulent wake of America’s protectionist tide.

“We’re watching a fundamental shift in North American trade dynamics,” says Michael Beaton, senior analyst at the Canadian Steel Producers Association. “This isn’t just about metals anymore—it’s about the entire framework of Canada-US economic relations.”

The impact of these tariffs extends far beyond immediate price fluctuations. Since the initial steel and aluminum tariffs implemented under former President Donald Trump in 2018, Canadian manufacturers have been navigating increasingly complex supply chains. When those tariffs were eventually lifted for Canadian and Mexican imports in 2019, many producers breathed a collective sigh of relief—one that now appears premature.

Industry data reveals Canadian steel exports to the US totaled $4.3 billion last year, representing over 70% of Canada’s total steel exports. The integrated nature of the North American supply chain means disruptions at any point reverberate throughout the system.

“What we’re seeing is a strategic recalibration,” explains Teresa Williams, trade policy director at CO24 Business. “The Biden administration is targeting China, but the ripple effects touch every trading partner, including Canada.”

Canadian steel producers now face a complicated scenario: potential market opportunities if Chinese imports to the US decrease, balanced against fears of diverted Chinese steel flooding the Canadian market. The situation has prompted calls for Ottawa to implement its own protective measures.

Deputy Prime Minister Chrystia Freeland addressed these concerns last week, emphasizing Canada’s commitment to defending domestic industries. “We will always stand up for Canadian workers and businesses,” Freeland stated. “Our approach to trade policy remains evidence-based and strategic.”

This strategy faces a stress test as US trade moves increasingly reflect domestic political considerations ahead of November’s presidential election. The battleground states of Michigan, Pennsylvania, and Wisconsin—all with significant steel industry footprints—remain crucial to electoral calculations.

Canadian producers are responding with their own strategic adjustments. Stelco Holdings has accelerated technological investments to increase production efficiency, while ArcelorMittal Dofasco has emphasized specialized high-margin steel products less vulnerable to commodity price fluctuations.

Trade experts watching these developments note the situation highlights Canada’s ongoing vulnerability to US policy shifts. “The fundamental asymmetry in the relationship means Canada must constantly balance cooperation with self-protection,” says Dr. Amanda Chen, international trade specialist at the University of British Columbia, in an exclusive interview with CO24 Breaking News.

For consumers, these trade tensions translate to potential price increases across sectors from construction to automotive manufacturing. The Canadian Chamber of Commerce estimates that sustained tariffs could add $300-800 to the cost of a new vehicle and increase home construction costs by 3-5%.

The current situation also reflects broader changes in global trade patterns. As supply chain resilience trumps efficiency in corporate planning, Canadian manufacturers are increasingly exploring reshoring options and diversifying supplier relationships.

“We’re witnessing the end of the post-Cold War trade consensus,” notes James Richardson, chief economist at RBC Capital Markets. “Countries are prioritizing economic security alongside traditional trade benefits, and Canada must adapt to this new reality.”

As Canadian officials prepare for upcoming bilateral trade discussions, the stakes extend beyond immediate economic impacts to the very nature of North American economic integration. Whatever emerges from this period of tension will likely shape continental trade relations for decades to come.

The question facing Canadian policymakers isn’t just how to respond to current US tariffs, but how to position the country in an era where the rules-based trading system that has benefited Canada for generations faces unprecedented challenges from all directions.

Sarah Patel covers trade and economic policy for CO24 Sports and CO24 Business.